Exploring the Investment Landscape and Value Capture of the AI-Powered New Economy: Part 2

TL;DR:

The AI-powered economy is transforming the investment landscape, with horizontal competition dominating the infrastructure layer and both horizontal and vertical competition in the model-to-application layers.

The value distribution depends on whether AI models converge or not. If they converge, customer-facing applications built on open-source AI models will likely dominate. If not, end-to-end applications developed by companies with the best AI models will capture more value.

Episode 1 of our series examined the transformative impact of AI technologies, including Large Language Models (LLMs), Generative Pre-trained Transformers (GPT), and OpenAI's ChatGPT, on the investment landscape. We highlighted their potential to revolutionize industries, elevate user experiences, and bring about a paradigm shift in human-computer interaction.

As we move on to Episode 2, our focus will be on understanding value accrual in the AI-powered economy. Our objective is to dissect the intricacies of value creation and distribution within this rapidly evolving ecosystem.

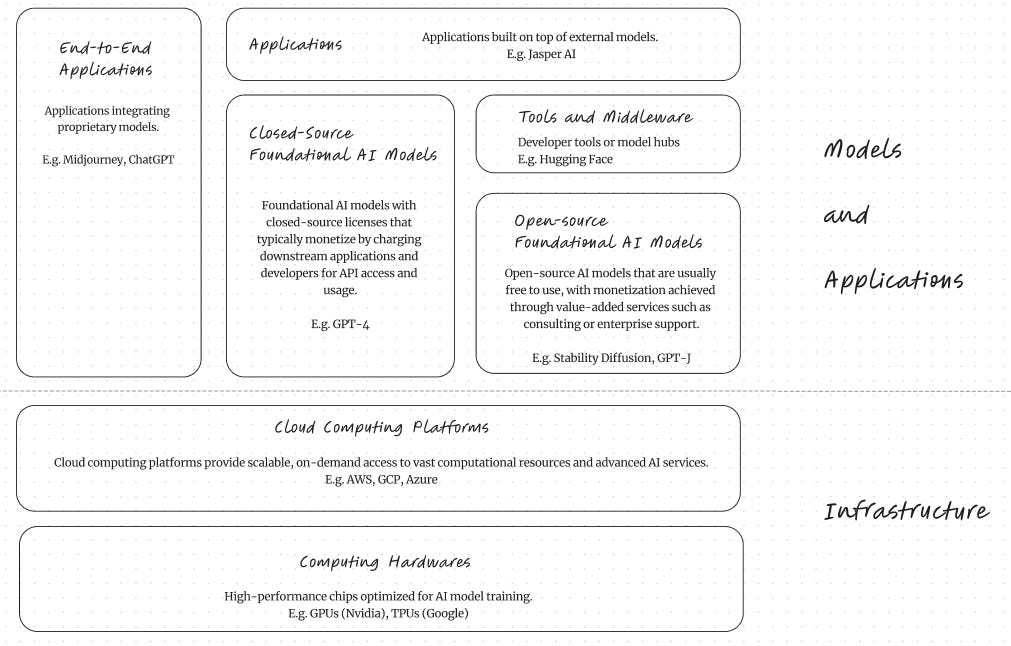

1. Defining the Modern AI Stack

The modern AI stack comprises multiple layers that contribute to the development, deployment, and utilization of AI technologies. A16z published an insightful article and chart illustrating the tech stack of modern generative AI. The chart below summarizes the article with a few updates and modifications.

2. Different Competitive Dynamics: Infrastructure vs. Application

The competitive dynamics at the base infrastructure layer differ significantly from those at the upstream application layer.

2.1 Infrastructure Layer: Horizontal Competition

As seen from the above chart, the value stack at the infrastructure layer is well-defined, featuring only horizontal competition.

For example, the three dominant cloud computing platforms—AWS, Google Cloud, and Microsoft Azure—compete horizontally with similar and well-established business models. They optimize cost-efficiency and performance to vie for market share.

Similarly, chip producers such as Nvidia, Google TPU, and AMD compete horizontally to gain market share in the AI computing chips market. So far, Nvidia has been the clear winner with A100 and H100 performing significantly better than alternatives.

It is widely believed that Nvidia will continue its dominance in this market due to its significant technological advantage. This has been reflected in Nvidia's market price, which has rallied over 60% since the release of ChatGPT on November 30th, substantially outperforming the NASDAQ index.

2.2 Application Layer: Vertical + Horizontal Competition

Unlike the infrastructure layer, the model-to-application layers experience both vertical and horizontal competition, with no consensus yet on how business models will be organized.

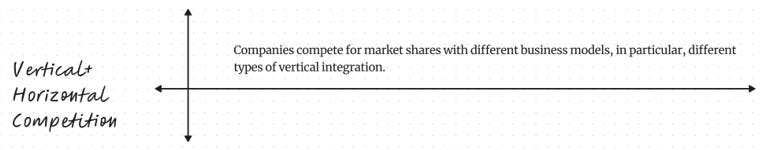

Historically, in the internet and mobile internet eras, applications existed as a relatively independent layer, sitting atop base layers (typically open-sourced). These applications directly faced consumers and were usually scaled through network effects. Most applications in today's Apple store follow this model.

However, it is unclear whether this will continue to be the dominant model in the upcoming AI-powered economy. There are three competing models without a clear winner yet (also defined in the chart below):

Option 1: End-to-end applications powered by proprietary models

Option 2: Applications built on closed-source AI models

Option 3: Applications built on open-source AI models

In many cases, applications might be situated between options 2 and 3, powered by both closed-source and open-source foundational models.

3. The Rise of Verticalization, as Demonstrated by ChatGPT

The initial popular view was that, similar to the internet era, options 2 and 3 would be the dominant business models in the AI era.

3.1 Jasper AI vs ChatGPT

This was demonstrated by the success of Jasper AI, an AI tool that helps businesses streamline content generation, automate repetitive tasks, and improve overall productivity by leveraging advanced natural language processing capabilities. Jasper has been powered by OpenAI's GPT-3.

The company is one of the fastest-growing, with revenue exceeding $75 million within two years. The business model (in between options #2 and #3) appeared to work well—until the release of ChatGPT.

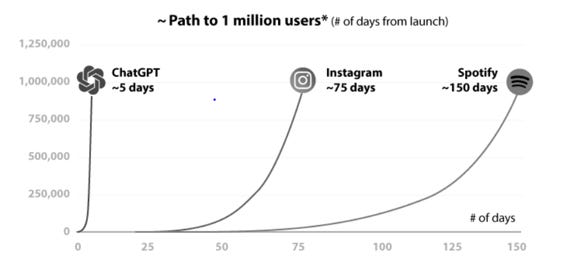

Powered by its proprietary language model, ChatGPT became the fastest-ever application in terms of customer acquisition historically, reaching 1 million users in just 5 days.

Unfortunately for Jasper AI, ChatGPT can perform virtually any task that Jasper AI can, without significant underperformance, while also handling a broader range of tasks. As a result, OpenAI's demo product now poses an existential risk to a star application like Jasper AI, making people aware of the powerful potential of option #1— a vertically integrated model.

3.2 ChatGPT Plugins

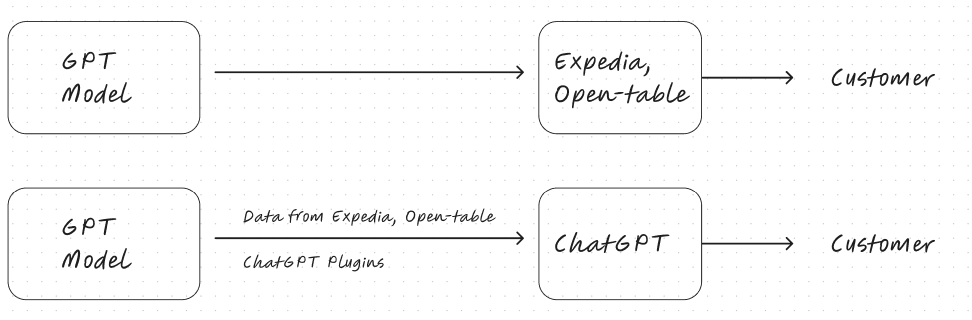

The recent release of ChatGPT plugins further confirmed OpenAI's ambition to continue down this end-to-end application path. Users can converse with ChatGPT and send instructions, and ChatGPT will call the appropriate plugins to complete the task (e.g., calling the OpenTable plugin to book a restaurant or the Zapier plugin to send an email).

This is a departure from the popular view that users would interact with OpenTable's platform, which would be connected to OpenAI's GPT models to enhance the experience.

With ChatGPT plugins, users face a single platform — ChatGPT — which consolidates data to perform various requests. Now, OpenAI not only develops phenomenal AI models to power the next revolution but also becomes the customer-facing application that controls data and networks.

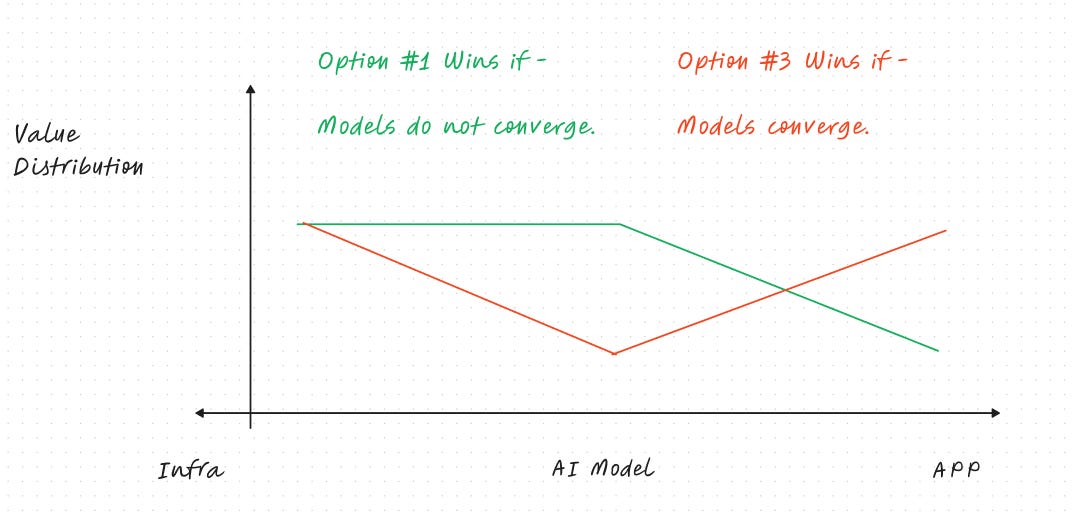

4. The Ultimate Decision Factor

A crucial question to determine whether verticalization will win this battle and how value will be distributed is whether AI models will converge. This will decide if value accrual favors companies building foundational models (in the case of option #1) or companies building customer-facing applications (in the case of option #3). Option #2 will likely see an outcome somewhere in between.

A popular view is that - as long as models are trained on similar datasets - they will eventually converge, exhibiting similar performance and even similar parameter sets.

In this model-converging scenario, AI models themselves are no longer the primary advantage. Platforms that have historically faced customers and owned vast amounts of data (e.g., Expedia, StackOverflow, Quora, etc.) possess strong bargaining power in the value distribution process since data is the ultimate differentiator. Open-sourced AI models could have an advantage over closed-sourced ones, as their free-to-use nature attracts a larger community of users and contributors.

This would most likely lead to a case where option #3 (i.e., applications built on open-sourced AI models) dominates, and applications capture more value compared to foundational model developers.

Conversely, if the models do not converge, the primary differentiation in the end product is the AI itself, and it is likely that option #1 (i.e., end-to-end model-application integration) will win out.

In this case, the pricing power is dominated by whichever company develops the best AI model (OpenAI at the moment), and companies building lightweight, application-only products (like Jasper AI) are unlikely to receive significant value distribution

Conclusion

The infrastructure layer, including chip producers such as Nvidia and cloud computing platforms such as AWS, is unlikely to face vertical competition and has a high likelihood of enjoying a significant share of value distribution.

The competition will only occur in the horizontal direction, and existing frameworks for evaluating performance will still apply. However, this relatively higher conviction could have been priced in already, as demonstrated by Nvidia's 150x P/E ratio.

Regarding the model-to-application layers, value distribution will likely depend on whether AI models converge or not.

If AI models converge, we will likely see a similar value stack to the traditional internet industry, with value accruing to customer-facing applications, which are likely powered by open-source AI models.

If AI models have strong defensibility and do not converge, we will see more end-to-end applications where the front-end application and back-end models are developed by the same company. In this scenario, the value will most likely accrue to companies that can develop the best AI models, with OpenAI as the apparent leader at the moment.

We recommend that investors exercise patience and avoid chasing deals before this key question becomes more apparent. By carefully observing the competitive landscape and the evolution of AI models, investors can make better-informed decisions about where to allocate their resources in the AI-powered economy.